Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

In a NutshellFlorida has two state laws that protect people during the debt collection process: the Florida Consumer Collection Practices Act and the Florida Commercial Collection Practices Act. The first law seeks to protect Floridians from harassment or unfair practices carried out by creditors. It mirrors and supplements the federal Fair Debt Collection Practices Act (FDCPA), which applies only to third-party debt collectors. The Florida Commercial Collection Practices Act protects people and companies that have business debt.

Written by Upsolve Team.

Updated February 9, 2024

These laws supplement the consumer protections outlined in the federal Fair Debt Collection Practices Act (FDCPA), which applies to all states.

The Florida Consumer Collection Practices Act (FCCPA) includes many of the same rights and protections as the federal FDCPA. Florida’s FCCPA goes a step further by extending these rights and protections to consumers against original creditors as well as third-party debt collectors. The FCCPA also requires debt collectors to be licensed.

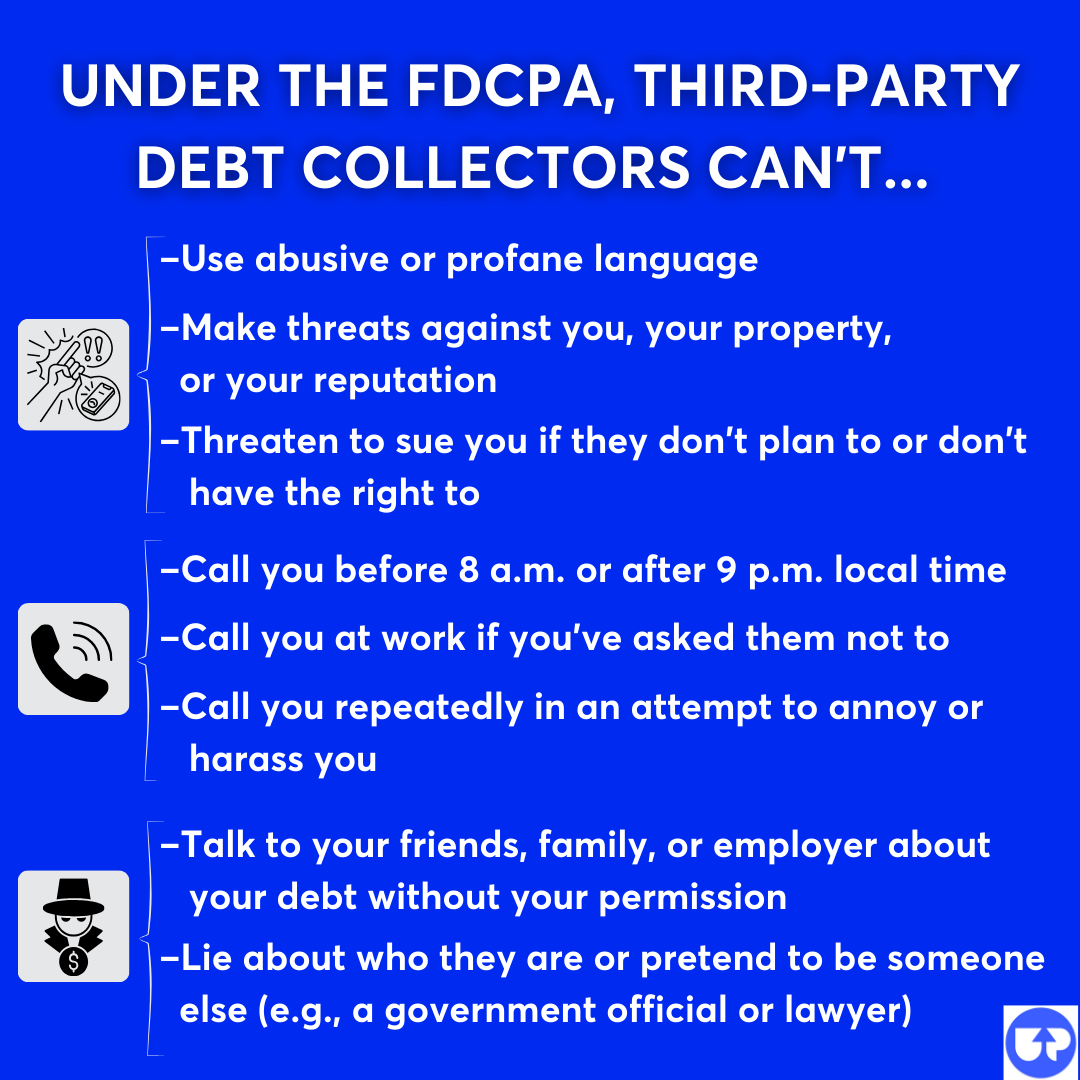

You can see specific examples of protections in the FDCPA below. The main goal of both laws is to prevent harassment and unfair practices in the debt collection process.

The Florida Commercial Collection Practices Act is a state law that addresses business or commercial debt collection practices in the state.

Here’s some basic information about the FDCPA:

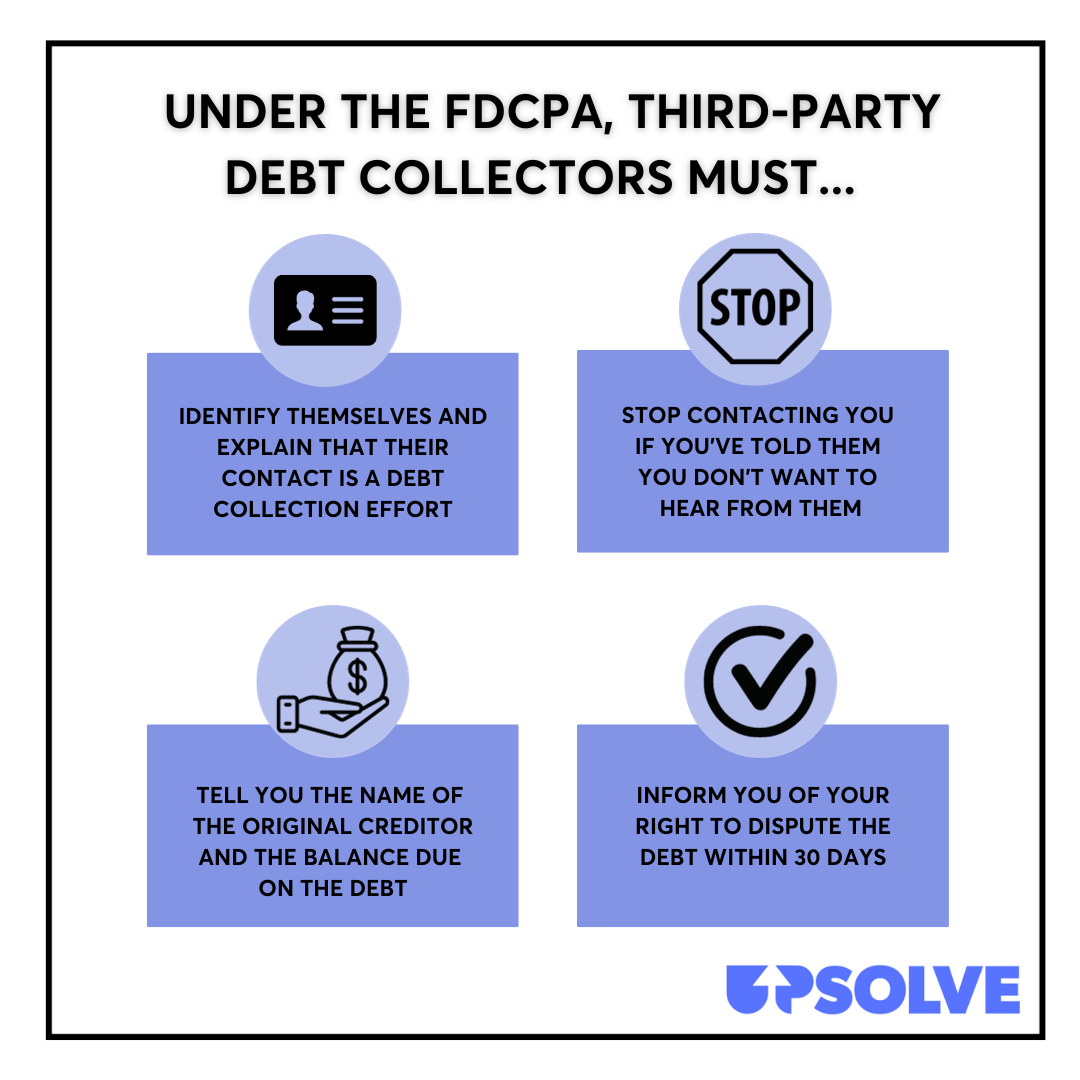

The FDCPA provides many important protections for consumers against third-party debt collectors. It also creates certain requirements debt collectors must follow, including:

Not all states require third-party debt collectors to be licensed, but the state of Florida does. That means, if you’re contacted by a debt collection agency, you can ask for their licensing number. Doing so can help you verify that the debt collector is legitimate and is legally allowed to operate in the state. This is a good way to ensure you don’t fall prey to a debt collection scam.

Also, if the debt collector isn’t properly licensed, you may be able to use this as a defense later if you are sued for the debt.

When you’re contacted about a debt, the debt collector must send a validation letter. You can ask for further information about the debt and debt collector by writing a debt verification letter. Here’s how to write a debt verification letter, including a template you can use. You can use the debt verification letter to dispute a debt you don’t believe you owe. It can also help buy you some time in dealing with the debt collection.

Absolutely recommend. Outstanding software that will ease the process of filing yourself. Easy to follow and understand.

Read more Google reviews ⇾ ★★★★★ 4 days ago The best decision I have made. Definitely the way to go. Read more Google reviews ⇾ Ititi Obidah ★★★★★ 4 days ago I am so grateful I found Upsolve to help file my case. You are a godsend. Thank you!! Read more Google reviews ⇾ Get Free HelpUnfortunately, debt collectors do sometimes break the law when trying to collect debts from individuals. If a debt collector harasses you, engages in unfair or deceptive practices, or does not follow other requirements set out in state and federal laws, you can file a complaint and/or take legal action.

If you believe a debt collector has broken the law, a good first step is to file a complaint with the Florida Attorney General’s office. This is a pretty straightforward process. You’ll provide your contact information and some information about the debt collector.

You may also be able to sue the debt collector in state court in the county where the violation occurred or where the alleged violator works. You must bring a lawsuit for violation of the Florida Consumer Collection Practices Act within two years of the date the violation occurred.

If your lawsuit is successful, you may be eligible for actual damages, statutory damages of up to $1,000, punitive damages, and attorney fees and court costs.

You can also look into filing a lawsuit for FDCPA violations in state or federal court. It may be useful to get legal advice and hire an experienced attorney to represent you. If you win the case, their fees should be covered.

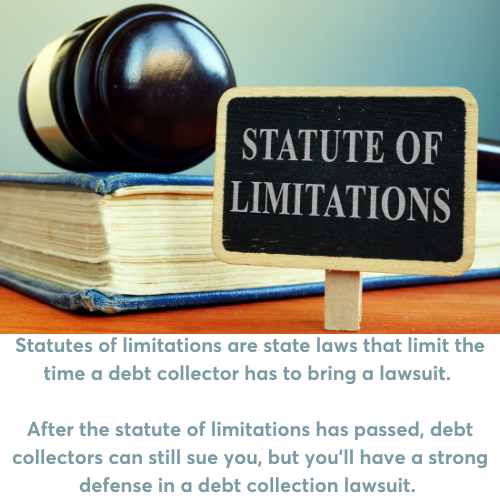

Consumer debts backed by written contracts have a statute of limitations of five years. The same timeline applies for open-ended credit accounts, like credit cards. Consumer debts based on oral contracts have a four-year statute of limitations.

The debt contract you signed when you took out a credit card or loan likely outlines when the account is considered in default. This often comes as a missed or late payment and a certain period of time (e.g., 30, 60, or 90 days). This is usually when the statute of limitations begins for the debt.

If you’re contacted about an old debt, be careful about what you say to the debt collector. If you make a payment on the debt, the statute of limitations may be restarted. Read Upsolve’s statute of limitations article to learn more about how these laws work and what your rights are.

Though they can't harass you, debt collectors can contact you via phone, mail, or even your social media accounts. If they can't reach you to deal with the debt, they may decide to sue you.

If they win the court case, they can get a court judgment to garnish your wages, take money from your bank account, or put a lien on any property you owe. If a debt collector get a court order for wage garnishment, they are limited in how much of your paycheck they can take. To learn more read our guide on Florida wage garnishment laws.

If you get sued, you may be temped to ignore the case and hope it goes away. Unfortunately, this isn't likely work. If you don't answer the court summons or appear for scheduled hearings, you will probably lose by default. If you're facing a debt collection lawsuit, the most important thing you can do is answer the summons and seek legal help if you need it. Learn more in our guide to answering a court summons for debt in Florida.

Many Americans are struggling with overwhelming debt. Consumer bankruptcy filing are up in 2023, and so is the amount of total consumer debt. The good news is that help is available and there are several debt-relief options.

If you want to learn more about which of these options can work best for you, schedule a free appointment with a consumer credit counselor. These trained professionals work at nonprofit credit counseling agencies whose mission is to help folks deal with their debt, learn to budget, and get their finances on track.

The credit counselor will talk to you about options like a debt management plan, debt consolidation, and bankruptcy. Filing bankruptcy is a serious measure, but it brings tremendous relief and a financial fresh start to thousands of people each year. To learn more, read our article: What is Chapter 7 Bankruptcy & Should I File?